Startup Financial Planning: Key Adaptations for Uncertain Times

Chosen theme: Startup Financial Planning: Key Adaptations. Welcome to your founder-friendly playbook for building resilient models, sharpening cash discipline, and pivoting funding strategies with confidence. Dive in, share your lessons, and subscribe for practical, field-tested insights that help you extend runway and make better decisions—especially when the ground shifts under your feet.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Expense Prioritization and Zero-Based Budgeting

Score each expense by direct impact on revenue, retention, or critical risk reduction. Attach a proof point—experiment result, customer feedback, or benchmark. Anything without proof goes to a 60-day watchlist. Share one expense you cut or defended this month and why; your reasoning could help another founder make a tough call.

Expense Prioritization and Zero-Based Budgeting

Identify flexible levers like marketing channels, contractor hours, and cloud resources. Predefine throttle ranges and review them weekly so you can dial up or down without chaos. Document the operational impact of each lever. Comment with your sharpest lever and the signal you watch, and we will compile a founder playbook of fast moves.

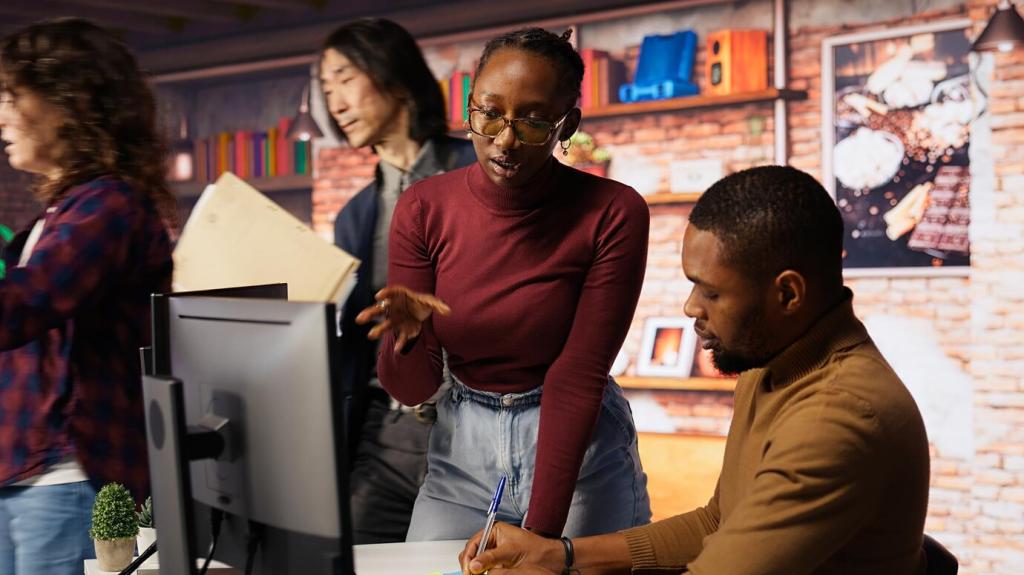

Funding Strategy Pivots

SAFEs can speed closes and reduce legal costs; priced rounds can help set clearer governance and valuation anchors. Choose based on runway needs and milestone clarity. Document why you picked one route over another so future investors see your logic. Share your path and what you would change; we will gather lessons for first-time fundraisers.

Funding Strategy Pivots

Explore grants, revenue-based financing, venture debt, and customer prepayments. Non-dilutive sources can extend runway without signaling risk if paired with prudent growth. Build covenant awareness and repayment models before signing. Drop a note on which sources you have tried and how you structured them, and we will spotlight creative examples.

Pricing, Monetization, and Unit Economics

Contribution Margin Under Stress

Break out variable costs by customer segment and product tier. Model contribution margin after discounts, support time, and payment fees. Stress test with higher costs and lower usage to see where margin collapses. Share your toughest margin surprise; we will compile fixes from founders who rebuilt margin without losing product love.

Pricing Experiments with Guardrails

Run small, time-bound experiments: different bundles, annual prepay incentives, or usage thresholds. Set guardrails for churn, conversion, and net revenue so you know when to roll back. Communicate transparently with customers to keep trust. Tell us your boldest pricing test and the learning it produced, and we will share anonymized comparisons.

Risk, Compliance, and Cash Safety

Map critical vendors, their single points of failure, and alternatives you can activate quickly. Negotiate exit clauses and clarify data access before emergencies. A founder recently avoided a week-long outage by keeping a shadow provider ready. Share your top vendor safeguard, and we will compile a resilience checklist you can run in one afternoon.

Risk, Compliance, and Cash Safety

Spread operational cash across institutions and understand insurance limits and settlement times. Establish an investment policy for idle cash that prioritizes safety and liquidity over yield. Review signatory controls quarterly. Tell us how you structure operating, payroll, and tax accounts, and subscribe to get a lightweight policy template you can adapt.